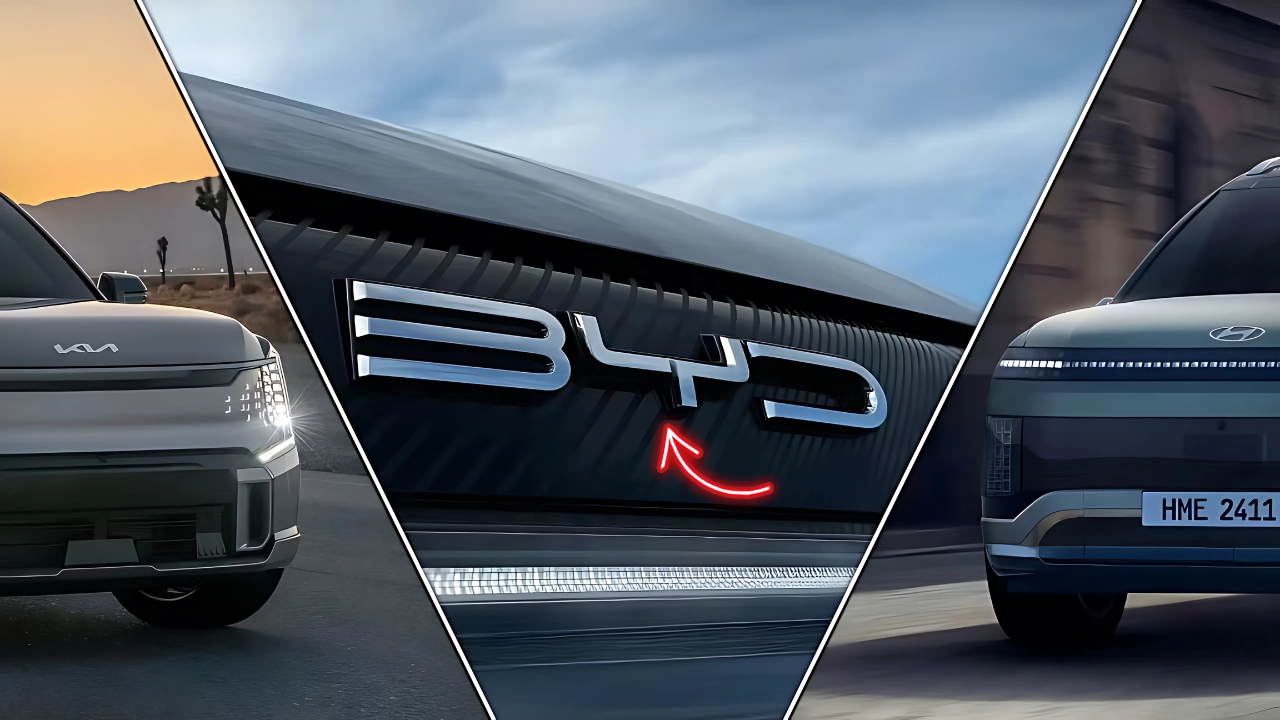

While several automotive manufacturers are stepping back from the large electric SUV segment, Chinese giant BYD is doubling down with ambitious plans to challenge the Kia EV9’s dominance. The company’s upcoming Tang electric SUV represents a bold move into territory that other brands are increasingly avoiding due to high development costs and market uncertainty.

BYD’s Strategic Counter-Attack

BYD Australia has identified a seven-seat SUV as a “top priority” for expanding its model range, with the Tang being the most likely candidate. This move comes as electric vehicle sales in Australia reached a record 114,000 units in 2024, representing nearly one in ten new car sales.

The Chinese automaker’s decision contrasts sharply with industry trends where traditional manufacturers are scaling back large EV investments. BYD’s confidence stems from its vertical integration capabilities and cost advantages in battery production, allowing them to compete aggressively on pricing.

Tang vs EV9: The Specifications Battle

The BYD Tang brings impressive credentials to challenge the Kia EV9’s starting price of around $56,395. The Tang offers a 7-seater configuration with all-wheel drive capability and premium leather interior as standard, positioning it as a direct competitor to Kia’s family-focused electric SUV.

| Feature | BYD Tang | Kia EV9 |

|---|---|---|

| Seating | 7 seats | 7 seats |

| Drive | AWD Standard | RWD/AWD Available |

| Safety Rating | 5-star Euro NCAP | 5-star ANCAP |

| Range | 400+ km | Up to 304 miles (489km) |

| Starting Price | Under $100k AUD | $56,395 USD |

Market Timing and Government Support

BYD’s timing aligns with Australian government initiatives including the New Vehicle Efficiency Standard and $39.3 million investment in charging infrastructure. The number of charging sites increased by 75% from 2022 to 2023, adding just under 350 new locations.

Why Other Brands Are Retreating

The large electric SUV segment faces unique challenges including higher battery costs, limited charging infrastructure for long-distance travel, and consumer price sensitivity. Many manufacturers are prioritizing smaller, more affordable EVs to capture broader market share.

However, BYD’s vertical integration across the entire supply chain, from batteries to motors, provides cost advantages that competitors struggle to match. This positioning allows them to enter markets others consider unprofitable.

Australian Market Opportunity

With electric vehicle market share jumping from 1.2% in 2019 to over 12% by 2023, Australia represents a significant growth opportunity. BYD expects to double its Australian sales in 2025, targeting over 40,000 units annually.

The company’s strategy focuses on filling gaps left by competitors, particularly in the seven-seater family SUV segment where options remain limited.

Frequently Asked Questions

Q: When will the BYD Tang launch in Australia?

A: BYD expects to introduce the Tang by late 2025 as part of their model expansion plans.

Q: How does the Tang’s price compare to the Kia EV9?

A: The Tang is expected to start under $100,000 AUD, potentially undercutting the EV9’s local pricing.

Q: What makes BYD confident about competing in large EVs?

A: BYD’s vertical integration and battery manufacturing expertise provide significant cost advantages over traditional automakers.